With Another Tax Hike, Delco Property Owners Are Paying for Long–Ignored ‘Structural Deficits,’ Officials Say

By Gawhara Abou-eid

January 30, 2026

The Delaware County Courthouse in Media, Pa. Photo: Delaware County

Delaware County raised its largest source of revenue — property taxes — by 19% in hopes of closing what officials describe as long–ignored “structural deficits” dating back to 2017. The increase marks the third consecutive year of higher property taxes, the second in the double digits, following nine years without county tax hikes under prior administrations — a period current council members say contributed to the county’s present fiscal imbalance.

How exactly are those additional dollars being allocated, and what does the increase mean for property owners and small business operators in a county dominated by homeowners and small employers?

The county’s total budget of $947,122,168 was adopted on Dec. 10 by a 4–1 vote of council, reflecting a 5.4% increase over its 2025 budget. A property owner with the county’s average assessed value of $255,472 will pay about $188 more annually in county taxes under the new budget, or $15.67 per month. In 2024, property taxes rose by around 5%, and by 23% the following year.

With this increase, property tax revenue is projected to rise to $268,885,000, or an increase of 18.7% from 2025, according to county figures. Nearly 67% of Delaware County households are owner–occupied, compared with about 33% renter–occupied, according to the Delaware County Economic Development Corporation. That means the majority of residents are directly affected by the tax increase.

Business impacts are concentrated among small employers. The Delaware County Chamber of Commerce reports that 74% of businesses in the county have fewer than 10 employees, while 17% employ between 10 and 100 people. Demographically, approximately 11% of county residents are foreign–born, and 1 in 10 entrepreneurs in Pennsylvania is an immigrant.

“This really was a part of a two–year process of fixing a deep structural deficit this county council has inherited going back to 2017 or 2018, thereabouts,” said Mike Connolly, the county’s communications director. “There was a little bit of a delay in terms of when this really had to be resolved. One of the things that the county had really been relying on was ARPA (American Rescue Plan Act) money and other COVID 19-era aid to states and counties that helped push this into the future a little bit, but the structural deficit that the county faced was pretty steep, and there’s no way that we would be able to make it in just one year without putting an undue burden on taxpayers or by just cutting spending in the services that folks really rely upon.”

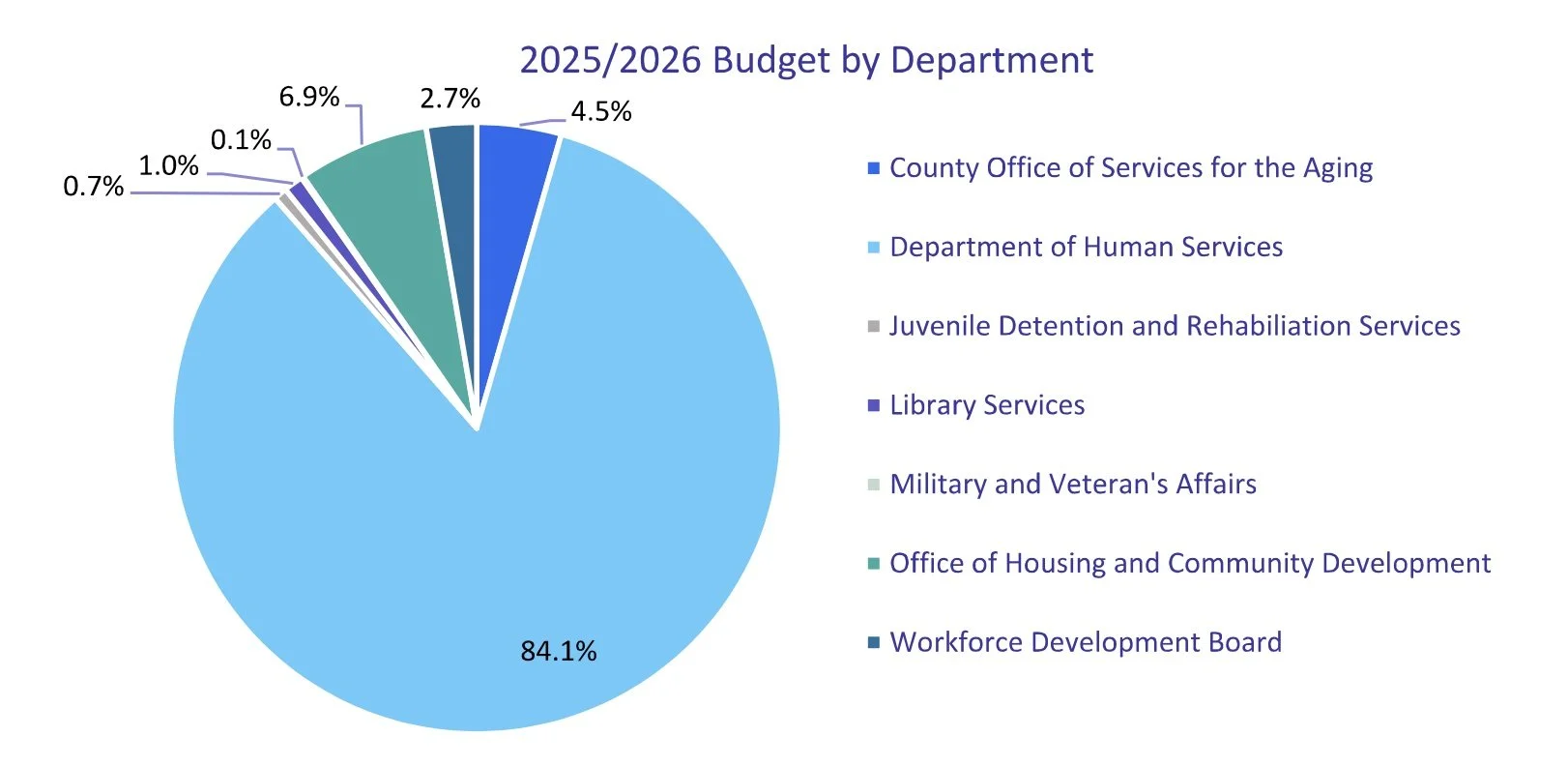

Delaware County’s adopted 2026 budget expenditures by department, provided by Delaware County’s budget management department. The Department of Human Services is the county’s largest expenditure.

Where Has the Tax Revenue Been Allocated?

Delaware County received $110,083,961 in ARPA and Local Fiscal Recovery Funds, with the first portion arriving in May 2021 and the second in June 2022. Under U.S. Treasury rules, all funds had to be obligated by Dec. 31, 2024, and spent by Dec. 31, 2026. By the end of 2024, the county had fully obligated the entire allocation across five eligible categories. About $59,993,903, or roughly 54.5%, was used to replace lost public sector revenue and “stabilize essential services.”

The bulk of property tax revenue this year, however, still funds the county’s core services. The Department of Human Services (DHS) remains the largest single expenditure, with $326,866,934 in the operating budget for 2026. According to the county budget, DHS achievements in 2024 and 2025 included launching an internal auditing framework, expanding the Drug and Alcohol Quality Management Program, rebranding the Healthy Kids/Healthy Schools Initiative as ConnectED, extending outreach at libraries and health clinics and stabilizing the workforce.

For 2025 and 2026, DHS goals focus on finalizing the Civil Service transition, expanding outreach to community partners such as the YMCA and local food pantries, producing a DHS Impact Report, improving oversight of contracted agencies and “pursuing partnerships to expand affordable housing and behavioral health programs.” Notably, some initiatives, including expanded outreach and workforce stabilization, appear in both past achievements and future objectives.

“The other big one is the George W. Hill Correctional Facility,” Connolly said. “We really have no choice but to have a facility that is safe and humane, but it’s not inexpensive to do that. And the court system is another driver of cost increases that we had to absorb in this year’s budget.”

The facility had been the only privately managed county prison in Pennsylvania. GEO Group operated the facility under a $259 million contract signed in 2018, but the county successfully deprivatized the jail in 2022, adding to county costs and maintenance. For 2026, the net cost of the facility to the county is projected at $60,245,000 in the operating budget, up from $46,420,972 in 2022.

Also included in the operating budget is Fair Acres Geriatric Center, the county’s long-term care facility for older adults. Spending rose 3.9% to $78,148,475 in 2026, covering major projects such as a kitchen overhaul and bathroom remodeling.

Capital expenditures for county facilities, which add additional pressure on homeowners, are funded through the capital budget of $127,225,839 (up 5.2%). From 2026 through 2030, the county has allocated $440.7 million for 142 capital projects, primarily funded through debt financing. Of that total, 58% is dedicated to facilities and buildings, 18% to parks, trails and open space, 12% to information systems and vehicle replacements, 9% to contingency, and 3% to transportation, including subsidies for SEPTA transit improvements.

Major projects include roof replacements at the Government Center, totaling $9,704,591 through 2028, and upgrades to meet Americans with Disabilities Act requirements, with a multi-year budget of $13,111,153. Connolly said these improvements are necessary to modernize county buildings, ensure public safety and maintain accessibility.

Across Delaware County’s 49 municipalities, officials say the tax increases are intended to support a longer-term plan to stabilize finances and move toward flat budgets in the coming years. Connolly pointed to a newly created budget task force that met throughout 2025 to review revenue strategies, spending priorities and cost-containment measures that were reflected in why the tax increase “was only 19%.”

“One of the things we obviously acknowledge is that it’s not going to be popular with a lot of the folks, that it’s pretty unpleasant,” he said. “We talked a little bit about the need, but one of the things the county has been focusing on is cuts and finding ways to preserve the services that folks rely upon, finding ways to become more efficient and bring every bit of savings that we can out of things.”

***

Gawhara Abou-eid is an Egyptian-American researcher and journalist from Lewisburg, PA and an Al-Bustan News media fellow. They hold a BA in International Relations from The George Washington University, with a concentration in International Security Policy. Gawhara has published research for the League of Arab States in Cairo, and their journalism has appeared in The Standard Journal and The News-Item.

Al-Bustan News is made possible by a grant from Independence Public Media Foundation.