As Health Insurance Subsidies Expire, Philadelphia’s Immigrant and Mixed–Status Families Face a Coverage ‘Cliff’

By Gawhara Abou-eid

December 23, 2025

As federal health insurance subsidies near expiration, immigrant and mixed–status families are among the most vulnerable in Philadelphia, confronting a coverage cliff that could reshape how thousands access care in 2026.

Since the pandemic, residents who buy insurance through Pennie, Pennsylvania’s Affordable Care Act (ACA) marketplace, have benefited from enhanced premium tax credits, which have lowered their monthly costs. Those subsidies are scheduled to expire on Dec. 31, 2025. When new coverage begins in January, many Philadelphia households are expected to face sharply higher bills.

The impact is expected to be particularly severe in Philadelphia, where marketplace enrollment is dense and incomes vary widely, marking the highest percent increase in a non–rural county. According to Pennie’s latest data, monthly premiums for enrollees statewide are expected to rise by an average of 102% in 2026 once the enhanced subsidies lapse. In Philadelphia County, the average increase is even higher at 116%, translating to about $137 more per member per month.

Neighboring suburban counties face smaller average increases, including Montgomery County at 63%, Bucks County at 66% and Delaware County at 70%.

Although higher premiums have not yet taken effect, advocates say the uncertainty alone is already driving concern. Shana Jalbert, director of communications for the Pennsylvania Health Access Network (PHAN), based in Philadelphia, said people are trying to understand what their coverage will look like in the coming year.

“Right now, people are still benefiting from the enhanced subsidies that Congress has been debating,” Jalbert said. “But starting in January, those will no longer be in effect unless Congress takes action very soon.”

For households hoping to keep their current plans, she said the projected increase is “a significant jump for most people to absorb.”

The average monthly percentage increase per policy as of 2026 for PA counties. Source: Pennie.com

The looming changes in eligibility are occurring against a backdrop of already high turnover in the marketplace. As of Dec. 21, well over 55,000 individuals are enrolled in Pennie plans across the Philadelphia–area congressional districts (PA‑02, PA‑03, and parts of PA‑05). According to Pennie, for each new enrollment, two people are terminating their coverage, and about 44% of new enrollees have not paid their January premium, suggesting additional dropouts may occur.

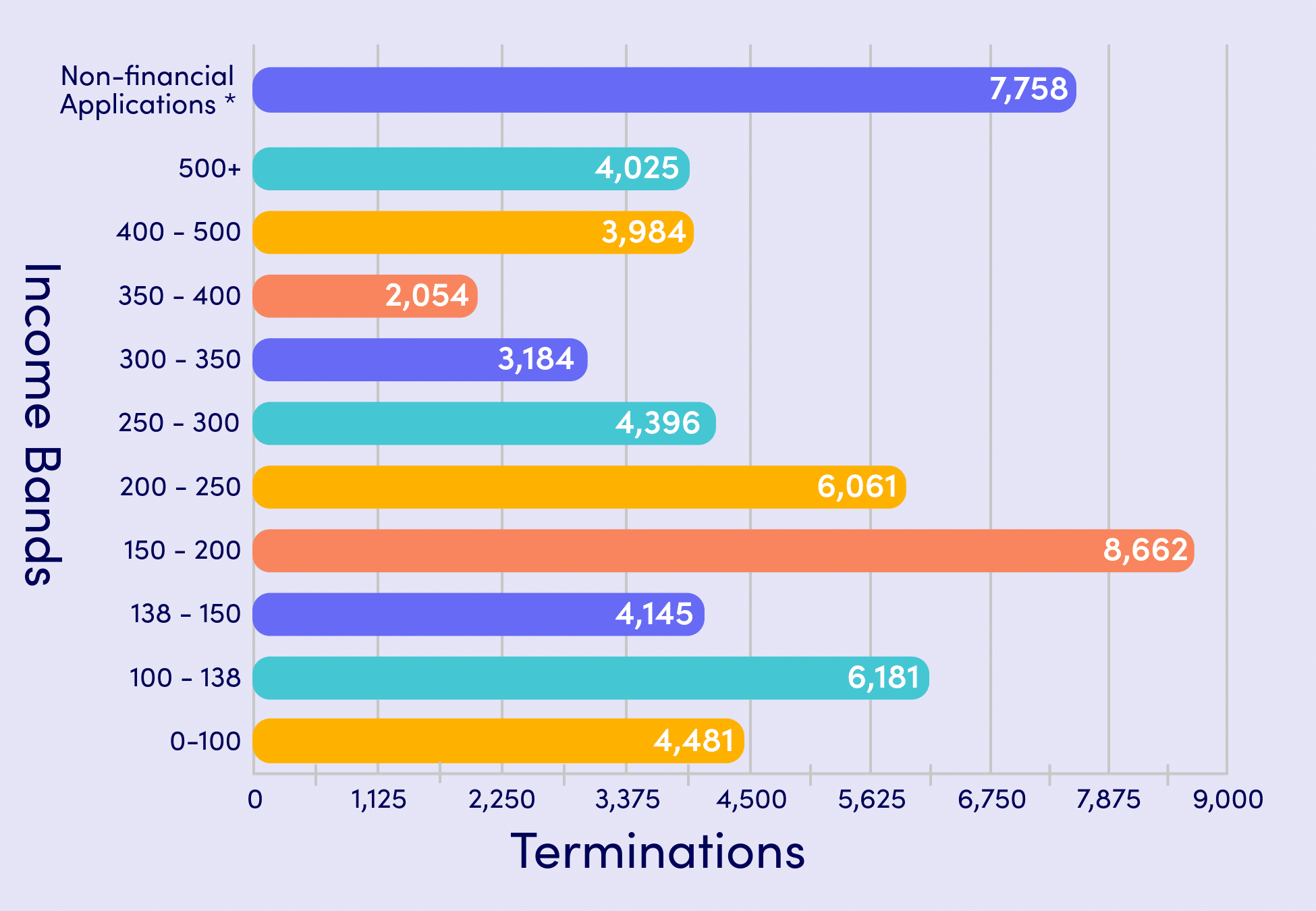

Pennie data also show that coverage losses are likely to affect certain age groups more than others, with higher disenrollment among adults ages 55 to 64, followed by younger adults ages 26 to 34. Philadelphia County has already seen a termination of 10% of enrollees, or just over 6,000 individuals. By income, terminations are most prevalent among individuals earning between $23,475 and $31,300, or families of four earning between $48,225 and $64,300, falling within the 150 to 200% Federal Poverty Level (FPL) range. These households are especially at risk of losing coverage due to changes in income or unresolved premium tax credit requirements.

Immigrant families in Philadelphia face added challenges layered onto the subsidy expiration. Beginning in 2026, low–income, “lawfully present” immigrants — the federal government’s term for noncitizens who are officially authorized to live and work in the U.S. — who are not eligible for Medicaid will lose access to premium tax credits through Pennie. Those credits had made marketplace plans accessible for people who otherwise had few options. While there is no change for “lawfully present” immigrants with incomes above the official low–income threshold (less than $62,000 per individual), additional eligibility shifts are expected in future years, according to Jalbert.

Additionally, Philadelphia County has the largest immigrant population in the commonwealth. Based on data collected through the 2022 American Community Survey by the U.S. Census Bureau, about 15.7% of Philadelphia residents are foreign–born.

“Immigrants are going to be even harder hit because they will no longer … be able to get any tax credits,” Jalbert said. “That means that their prices may go up even more than what we’re talking about, because the EPTCs (Enhanced Premium Tax Credits) are kind of like a subsidy on top of a subsidy.”

Another group will lose access altogether. DACA recipients, also known as Dreamers, will no longer be eligible to enroll in Pennie plans. According to Jalbert, mixed-status families often face complex coverage decisions, as eligibility can differ within the same household. She emphasized that trained enrollment assistors regularly work with these families to explain options based on individual circumstances. The organization’s helpline offers interpretation services in any language.

Pennie data on terminations of coverage for 2026 by age (above) and by income (below). Source: Pennie.com

The projected changes are already reflected in outreach demand. During the current open enrollment period, call volume to PHAN has increased as people who previously re–enrolled automatically now seek guidance.

To shop around the marketplace, Jalbert recommended reaching out to PHAN’s helpline, where trained enrollment assistors can help households compare plans, check if their doctors or medications are covered and understand costs.

Despite the uncertainty, advocates are urging residents not to disengage. Jalbert stressed that Pennie plans are required to cover essential health benefits, including preventive care, mental health services and maternity care.

“Even if you enroll, if you have coverage through Marketplace, you should keep an eye out for communications from Pennie, because if Congress does take action, Pennie is going to do its best to try to make that change as soon as possible to reduce people’s costs,” she said. “But we want people to make sure that they’re keeping an eye on that … I just don’t want people to get discouraged, walk away and miss the opportunity to get coverage. That’s what we’re most concerned about.”

Open enrollment continues through the end of the year for coverage beginning Jan. 1, with later enrollment leading to a Feb. 1 start date. In the absence of federal changes, immigrant and mixed–status families in Philadelphia are being asked to make health coverage decisions amid uncertainty that could leave many without affordable options in the year ahead.

“For the people affected, this isn’t just a price increase — it’s often the loss of their only realistic path to coverage,” Jalbert said. “Without those credits, many plans become completely out of reach, leaving families to choose between going uninsured or relying on safety–net clinics.”

***

Gawhara Abou-eid is an Egyptian-American researcher and journalist from Lewisburg, PA and an Al-Bustan News media fellow. They hold a BA in International Relations from The George Washington University, with a concentration in International Security Policy. Gawhara has published research for the League of Arab States in Cairo, and their journalism has appeared in The Standard Journal and The News-Item.

Al-Bustan News is made possible by a grant from Independence Public Media Foundation.